Key Considerations for Consignees When Importing from China to the U.S. via DDP – A Detailed Analysis of the DDP Incoterm

Introduction

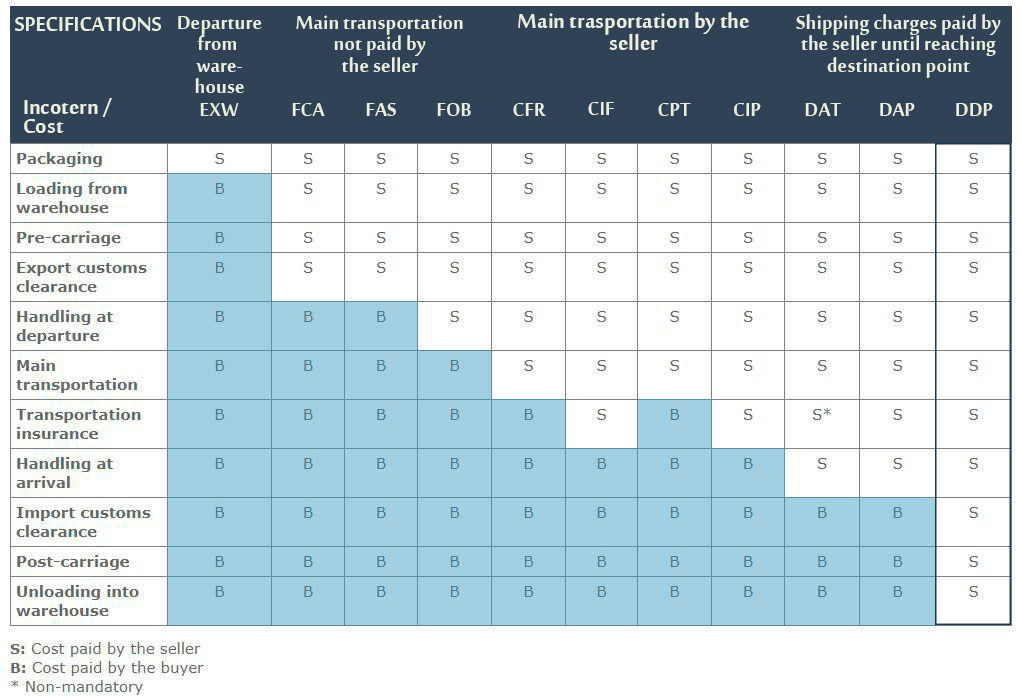

Delivered Duty Paid (DDP) is among the most comprehensive Incoterms® offered by the International Chamber of Commerce. Under DDP, the seller assumes maximum responsibility, including transport, customs clearance, duties, and taxes, delivering the goods to the consignee’s location in the importing country. While DDP streamlines many logistical hurdles, consignees must remain vigilant about several nuanced obligations and potential risks.

What DDP Means for the Consignee

- Minimal obligations, limited to receiving and unloading the shipment at the agreed destination.

- Risk transfer occurs only when the goods are made available and ready for unloading at the specified location.

- The consignee typically doesn’t handle import clearance or pay customs duties—these responsibilities lie with the seller.

Key Considerations for the Consignee

A. Precise Destination Specification

Ensure the contract clearly states the full address or location where delivery—and risk transfer—will occur. Ambiguity here can lead to misunderstanding about liability for unloading or final delivery.

B. Legal and Tax Implications of Seller Handling Import Clearance

Although the seller handles customs clearance, some countries—including the U.S.—may require the importer of record to hold specific registrations or bonds. If the seller isn’t properly registered, shipments could be delayed or subject to fines.

C. Cost Transparency and Pricing

While DDP simplifies finances for the consignee, the total landed cost is embedded in the seller’s price. Sellers often build in margins for tariffs, handling, and brokerage services, making direct cost comparison with other terms (like DAP or FOB) essential.

D. Customs and Compliance Complexity

The U.S. maintains stringent customs procedures. If the seller misdeclares value or fails to meet compliance standards, goods may be detained, inspected, or delayed—even under DDP—resulting in additional charges or demurrage.

E. Choosing a Trustworthy Freight Forwarder

Selecting a reliable logistics partner is critical. A forwarder with strong U.S. customs experience ensures smoother clearance. Consignees should confirm that forwarders have customs brokerage expertise and strong inland delivery networks.

F. Handling Insurance and Loss during Transit

Although DDP places liability with the seller until delivery, consignees should clarify whether insurance is included, and what happens in case of damage or loss before delivery is effected.

G. Unloading and Onsite Inspection

Delivery under DDP ends before unloading; the consignee must handle unloading and inspect the goods promptly. Delays or damages incurred post-delivery fall under the consignee’s responsibility.

DDP Incoterm Breakdown (Seller vs. Buyer Responsibilities)

| Party | Responsibilities under DDP |

|---|---|

| Seller | – Packaging, export clearance, documentation – International and inland transportation – Import customs clearance, payment of duties/taxes – Final delivery to consignee’s named place |

| Consignee (Buyer) | – Receipt of goods – Unloading at destination – Inspection and acceptance – Any post-delivery handling/storage |

This aligns with ICC’s Incoterms® 2020 rules for DDP, which place maximum obligations on the seller and minimal on the buyer, with risk transfer occurring only when goods are ready for unloading at the named place of delivery.

Summary for Consignees

- Ensure clarity on the named delivery address to avoid unloading misunderstandings.

- Verify seller’s ability to act as a compliant importer into the U.S.—customs bonds and registration may apply.

- Review the cost structure carefully—DDP prices include duties, taxes, and logistics margins.

- Assess customs and compliance risk, even under DDP, to avoid delays or fines.

- Select a reputable freight forwarder with strong U.S. customs and delivery experience.

- Clarify insurance coverage during transit to safeguard against loss or damage.

- Prepare for unloading and inspect goods immediately—responsibility shifts upon delivery.

Conclusion

In a DDP arrangement, the buyer enjoys near-complete logistical and financial relief: the seller shoulders export documentation, freight, import duties, and customs clearance, delivering goods to the agreed-upon U.S. location. However, consignees must safeguard themselves by confirming the seller’s ability to serve as importer of record, verifying the inclusion of adequate insurance, ensuring transparent landed cost, and preparing to receive and unload upon delivery. Clear contract language and proactive communication with freight forwarders can make DDP a highly efficient and reliable import solution—if executed with care.

Welcome to contact with us for more details of DDP term service.